The Best Guide To Pvm Accounting

The Best Guide To Pvm Accounting

Blog Article

Rumored Buzz on Pvm Accounting

Table of ContentsThe Buzz on Pvm AccountingPvm Accounting - An OverviewNot known Details About Pvm Accounting Fascination About Pvm AccountingTop Guidelines Of Pvm AccountingTop Guidelines Of Pvm Accounting

Manage and handle the development and approval of all project-related payments to customers to promote excellent communication and prevent issues. construction accounting. Make sure that ideal reports and documents are submitted to and are updated with the IRS. Make sure that the accountancy procedure follows the legislation. Apply needed building bookkeeping criteria and treatments to the recording and coverage of construction activity.Understand and preserve common price codes in the accounting system. Communicate with numerous financing companies (i.e. Title Firm, Escrow Firm) concerning the pay application process and demands needed for settlement. Manage lien waiver dispensation and collection - https://anotepad.com/notes/4hdynf83. Monitor and settle bank issues consisting of charge abnormalities and examine distinctions. Help with applying and maintaining inner monetary controls and treatments.

The above statements are intended to describe the basic nature and level of work being performed by people assigned to this classification. They are not to be interpreted as an extensive checklist of obligations, duties, and skills required. Personnel might be needed to perform obligations outside of their normal responsibilities once in a while, as required.

Top Guidelines Of Pvm Accounting

You will aid support the Accel team to ensure shipment of effective on time, on spending plan, projects. Accel is seeking a Building and construction Accountant for the Chicago Workplace. The Building Accounting professional performs a selection of accountancy, insurance conformity, and project administration. Functions both separately and within details departments to preserve monetary records and ensure that all records are kept present.

Principal tasks include, but are not limited to, handling all accounting features of the firm in a prompt and accurate manner and supplying records and timetables to the business's CPA Firm in the preparation of all financial statements. Guarantees that all accountancy treatments and functions are managed accurately. In charge of all financial records, payroll, financial and everyday operation of the accounting function.

Prepares bi-weekly test equilibrium records. Functions with Task Supervisors to prepare and publish all regular monthly invoices. Processes and issues all accounts payable and subcontractor payments. Produces regular monthly recaps for Workers Payment and General Obligation insurance coverage premiums. Creates month-to-month Task Cost to Date records and working with PMs to integrate with Job Managers' allocate each job.

Things about Pvm Accounting

Effectiveness in Sage 300 Building and Actual Estate (formerly Sage Timberline Office) and Procore building monitoring software a plus. https://pvmaccount1ng.blog.ss-blog.jp/2024-05-22?1716376193. Must also excel in other computer system software program systems for the preparation of records, spread sheets and various other accountancy evaluation that may be required by monitoring. construction bookkeeping. Must have strong business skills and capacity to prioritize

They are the economic custodians that ensure that construction tasks continue to be on budget, comply with tax obligation laws, and keep monetary openness. Building accounting professionals are not simply number crunchers; they are tactical partners in the building procedure. Their primary duty is to handle the economic aspects of building and construction tasks, making certain that resources are assigned efficiently and financial dangers are reduced.

Pvm Accounting - The Facts

They work carefully with project managers to create and keep track of budgets, track expenses, and forecast financial needs. By keeping a tight grip on job financial resources, accountants aid avoid overspending and monetary setbacks. Budgeting is a cornerstone of successful building and construction tasks, and building accounting professionals are critical in this regard. They develop comprehensive budgets that include all job expenses, from products and labor to permits and insurance.

Browsing the complex internet of tax regulations in the building sector can be challenging. Building and construction accountants are fluent in these regulations and make sure that the task abides by all tax obligation requirements. This includes managing pay-roll tax obligations, sales tax obligations, and any type of other tax obligation commitments specific to construction. To succeed in the duty of a building accounting professional, people require a solid instructional structure in accounting and finance.

Furthermore, certifications such as Qualified Public Accounting Professional (CPA) or Licensed Construction Sector Financial Specialist (CCIFP) are extremely concerned in the industry. Building and construction jobs typically involve limited deadlines, transforming guidelines, and unexpected expenditures.

Some Ideas on Pvm Accounting You Need To Know

Ans: Construction accountants develop and keep an eye on budgets, recognizing cost-saving opportunities and making certain that the job stays within budget. Ans: Yes, building and construction accountants take care of tax conformity for building and construction tasks.

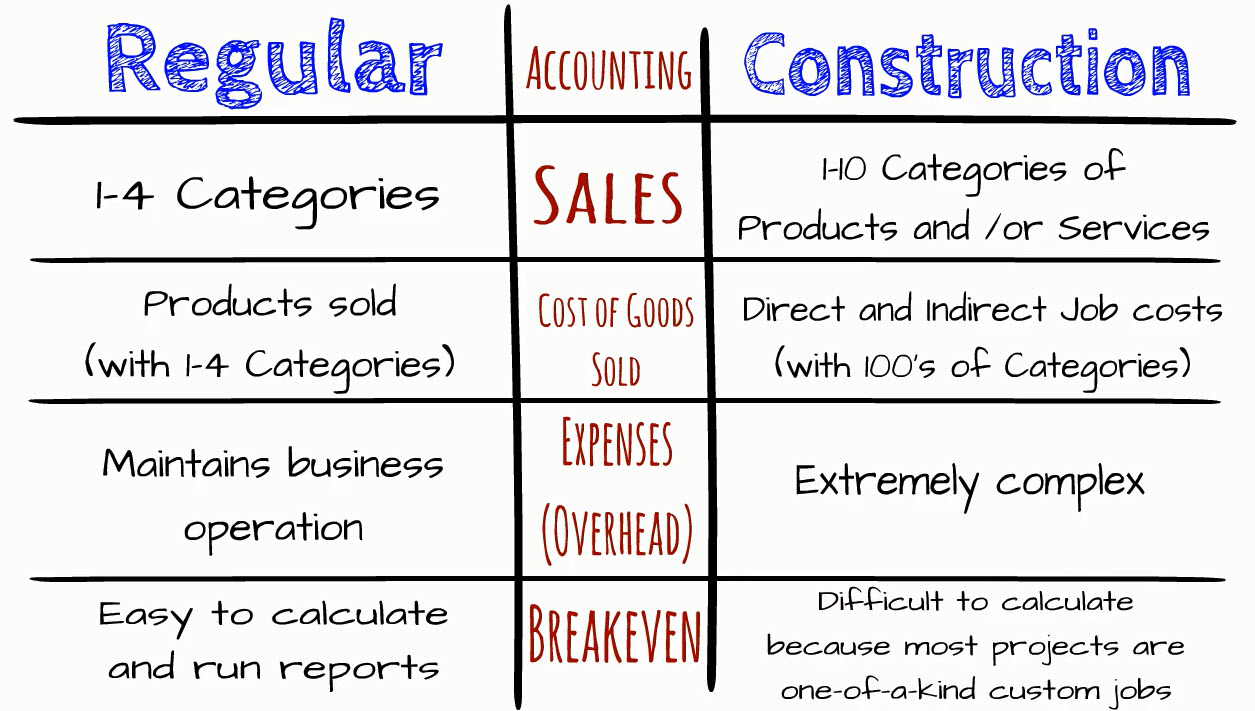

Introduction to Building And Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business have to make tough selections among lots of financial choices, like bidding on one project over an additional, selecting financing for products or equipment, or setting a task's earnings margin. On top of that, building is an infamously volatile industry with a high failure price, slow-moving time to payment, and irregular capital.

Production includes duplicated processes with conveniently recognizable costs. Production needs various processes, products, and equipment with varying expenses. Each task takes place in a new location with varying website problems and unique challenges.

All about Pvm Accounting

Constant use of various specialized specialists and distributors influences effectiveness and cash flow. Settlement shows up in full or important source with routine payments for the complete contract quantity. Some part of payment may be held back up until project conclusion even when the contractor's work is ended up.

While traditional makers have the benefit of controlled atmospheres and maximized production procedures, building and construction companies need to constantly adapt to each brand-new task. Even somewhat repeatable tasks call for modifications due to site conditions and other variables.

Report this page